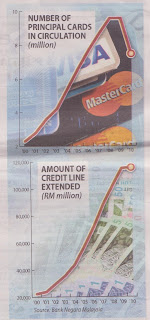

Bank Negara Malaysia is tightening credit card requirements for those in the lower-income bracket to keep household debt at manageable levels.

With immediate effect, first-time applicants for a credit card must now have a minimum monthly salary of RM2,000 from RM1,500 previously.

According to Bank Negara Malaysia deputy governor, Nor Shamsiah Mohd Yunus, new and existing cardholders earning RM36,000 per annum and less, can hold only credit cards from a maximum of two issuers. The maximum credit limit has been capped or two times the monthly income of the cardholder

For existing cardholders, they need to choose their preferred two issuers by December 31. For those existing cardholders who are earning less than RM24,000 per annum, they need not surrender their credit cards.

Nor Shamsiah said cardholders would be given at least two years to service their outstanding debt for cancelled cards to comply with the new requirement

For existing cardholders, whose outstanding balance exceeds the maximum credit limit, a grace period of two years will be given to settle the amount in excess of the maximum credit limit

From January 1 onwards, issuers shall review cardholders’ eligibility on the anniversary date of the credit card. During the review, if cardholders have fulfilled their quota of holding credit cards from two issuers, the issuer shall not extend their credit card facility to the cardholder.