|

| Mortgage |

Financial institutions may be more stringent and thorough in vetting your housing loan application; you still can get your application considered favorably. Here are the things you can do:

1. Debt to Income Ratio: According to Wikipedia, a debt-to-income ratio (often abbreviated DTI) is the percentage of a consumer's monthly gross income that goes toward paying debts. The bank may still approve your loan even your debt ratio is above 30%, it is prudent to maintain it at 30% and below. It means for every $100 of your income only $30 or less should go to paying your debt (such as personal loan, car loan, and housing loan).

2. CreditWorthiness: Are you paying your credit card bills in a timely fashion. If you don’t your credit rating will be impacted negatively. It implies that you are not able to manage your personal finance and honor your financial commitments. In Malaysia, you can get a copy of your report from the Central Credit Reference Information system once a year. It is a record of all your loans and payment pattern. When you default in payments, it is reflected in the data. A bad record will get your application rejected even if you meet other requirements

3. Save for a bigger down payment: One effective way to get a loan is to apply for a smaller amount. You need to save for a bigger initial payment. You borrow less, incur less interest, and get shorter loan tenure.

4. A permanent job with a permanent address: It is an important factor that you are able to hold down a job and not moving about without a full-time career and a fixed place to live. It tells others that you may not have a regular income to service your loan.

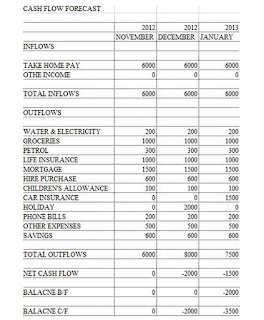

5. Budget: Have you factored in the amount you need to pay the bank every month and other debts you need to service? Your monthly budget should be within your income or else you are going to incur new debt. You will be in a danger zone when you need to borrow more to cover your monthly expenditures. Be wise and be comfortable living within your means to avoid a financial crisis.

A housing loan is a good debt because landed properties appreciate in value over time. Wisely review your financial situation before you sign on the dotted line for a mortgage.

Source: 5 Tips to Get Your Mortgage