According to the Census Bureau, one in every six Americans is living in poverty. The population of Malaysia is more than 27 million but there are 47.8 million people struggling in America. How do you deal with poverty effectively?

• Professional and technical skills: It is essential to obtain professional expertise such in law, marketing, computer science, and accountancy. If not, you can also acquire technical know-how like plumbing, wiring, and carpentry. The most important thing is to equip yourself with marketable talents that you can apply what you know throughout your life. As long as you are not lazy, you can work, earn, and live a decent life and avoid poverty. It is also prudent to renew what you have learned and keep yourself updated by learning new things relating to your trade.

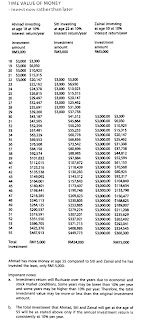

• Start early to save: First of all, you develop a saving habit at an early age. Secondly, the sooner you start to save the more you will be able to accumulate over the long haul. The power of compound interest will work wonders for your money.

• Invest wisely: Invest for the long term. .Avoid get-rich-quick schemes which are too good to be true. Growing your wealth is like growing a tree, it takes time and patience.

• Live within your means: Spending less than what you have earned means there is an excess fund to save and invest. It is also a great way to avoid getting into debt by overspending.

• Avoid bad habits: Bad habits like gambling, smoking, and drinking hurt not only financially but your well-being as well. Smoking will affect not only your health but others who are close to you. Drinking can ruin your life when you are involved in a fatal accident after drinking too much. Gambling is the fastest way to incur unmanageable debt.

• Debt-free: Use your credit cards with caution. Use them for convenience only and not to pile up debts. Getting into debt is easy, but getting out of it is difficult. Pay fully and promptly every month to settle credit card bills.

• Less material wants: When you want less, you spend less and you allow your money to grow further when you don’t touch it.

Be knowledgeable, skillful, and avoid bad habits are the ways to be financially independent and avoid poverty.

Source:7 Effective Ways to Avoid Poverty

• Professional and technical skills: It is essential to obtain professional expertise such in law, marketing, computer science, and accountancy. If not, you can also acquire technical know-how like plumbing, wiring, and carpentry. The most important thing is to equip yourself with marketable talents that you can apply what you know throughout your life. As long as you are not lazy, you can work, earn, and live a decent life and avoid poverty. It is also prudent to renew what you have learned and keep yourself updated by learning new things relating to your trade.

• Start early to save: First of all, you develop a saving habit at an early age. Secondly, the sooner you start to save the more you will be able to accumulate over the long haul. The power of compound interest will work wonders for your money.

• Invest wisely: Invest for the long term. .Avoid get-rich-quick schemes which are too good to be true. Growing your wealth is like growing a tree, it takes time and patience.

• Live within your means: Spending less than what you have earned means there is an excess fund to save and invest. It is also a great way to avoid getting into debt by overspending.

• Avoid bad habits: Bad habits like gambling, smoking, and drinking hurt not only financially but your well-being as well. Smoking will affect not only your health but others who are close to you. Drinking can ruin your life when you are involved in a fatal accident after drinking too much. Gambling is the fastest way to incur unmanageable debt.

• Debt-free: Use your credit cards with caution. Use them for convenience only and not to pile up debts. Getting into debt is easy, but getting out of it is difficult. Pay fully and promptly every month to settle credit card bills.

• Less material wants: When you want less, you spend less and you allow your money to grow further when you don’t touch it.

Be knowledgeable, skillful, and avoid bad habits are the ways to be financially independent and avoid poverty.

Source:7 Effective Ways to Avoid Poverty