|

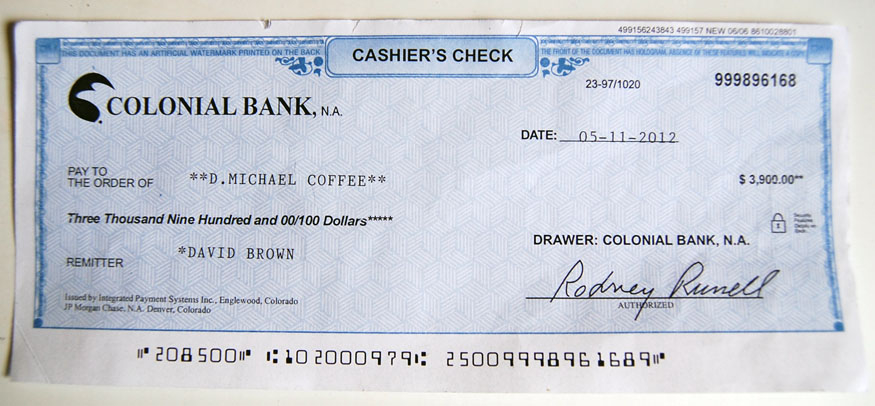

| Cashier's Check |

“Cashier’s check” is one of those financial terms that you may have heard thrown around, but what does it really mean? How is a cashier’s check different than a regular check, and why would you need to use one? Is it the same as a certified check? We’ll answer those questions and more below.

What Is a Cashier’s Check?

A cashier’s check is one drawn directly from a bank’s own funds in the bank’s name. It’s typically signed by a teller (also known as a cashier — hence the name). The bank is responsible for paying the amount on the check directly to the payee. This is in contrast to a personal check, which is drawn on your account and authorized by your signature.

You may be required to use a cashier’s check instead of a personal check for a particularly large or important purchase, such as making the down payment on a house or car. Since the cashier’s check is drawn from a bank’s funds instead of your personal account, the seller knows it won’t bounce. A personal check would offer no such assurance.

Another advantage of a cashier’s check over personal checks: Funds from cashier’s checks are made available almost immediately — the next day at the latest. A personal check is vulnerable to longer processing times, and large amounts are at particular risk of long holds.

How do I get a cashier’s check?

Getting a cashier’s check is something you can only accomplish offline. To get one, you’ll need to do some banking the old-fashioned way: Go into your local bank branch or credit union and request one from a teller.

You’ll want to bring your ID, and make sure you know all of the necessary information for the check: the payee’s name, the exact amount, and any notes that should be included.

If you have an account with that bank or credit union — it can be a savings or checking account — the teller will simply confirm that you have the funds and take that amount from your account before handing over the check. If you don’t have an account there, you’ll need to have enough cash to cover the check amount.

Note that some banks won’t issue cashier’s checks if you don’t have an account with them, so it’s worth calling ahead if you aren’t a current customer.

What does a cashier’s check cost?

You’ll typically have to pay a fee before a cashier’s check is issued, though some may issue them free for all or certain customers. Fees vary from bank to bank, but the largest banks in the U.S. charge anywhere from $7 to $10 for the service, according to MyBankTracker. Other banks may actually charge a percentage of the check total instead of a flat fee.

Are there cashier’s check scams I should watch for?

Unfortunately, yes, but these scams are more likely to entangle the recipient of the check rather than the sender. Like any other checks, cashier’s checks are vulnerable to forgery.

One particularly popular scam has the “payer” sending a check for an amount that is greater than he or she needs to pay, then asking the payee to return the difference in cash or via a wire transfer. The catch, of course, is that the check turns out to be bogus.

If you’re accepting a cashier’s check as payment, make sure you accept one for only the agreed-upon amount. You can also verify that the check is legit by calling the bank where it was supposedly issued — just be sure to track down the bank’s contact information from a trusted outside source.

Alternatives to Cashier’s Checks

If you need a more secure way to pay someone than cash or a personal check, a cashier’s check isn’t your only option. Here is a rundown of some of your other options, and how they differ from cashier’s checks:

Certified checks

You might find that a bank teller automatically assumes you want a cashier’s check even if you ask for a certified check. That’s because certified checks have become increasingly rare, and many people use the terms interchangeably. (My own mother, a bank teller for more than 20 years, has only issued two or three certified checks in that time.) But there is a difference.

A certified check is still a personal check — unlike a cashier’s check, the money is drawn from your account, not the bank’s. However, both you and the bank sign it. The bank’s signature essentially guarantees the payee that you have funds available in your account to pay the check amount, which the bank can freeze until payment. Because both you and the bank sign the check, both of you could be held liable if there is a problem with payment.

Practically, both a cashier’s check and a certified check are more secure ways to guarantee payment than a personal check. However, a cashier’s check may have an edge from a security standpoint. Since it comes solely from the bank’s account, there aren’t as many chances for issues such as fraud or payment disputes.

Money orders

A money order offers another secure way to pay someone. You fork over money to an institution, and they give you a money order that looks a lot like a check. You verify the amount, fill in the payee and sometimes your own personal information, and sign the front. The money order is then sent to the payee, who must sign the back to receive the funds. You can ensure it’s delivered by using a tracking number on your receipt.

Like a cashier’s check, there is a fee to get a money order. Fees vary widely, but banks and credit unions are usually the more expensive option, charging around $5 to $10. You can get a money order for just a dollar or two at the post office or Wal-Mart. Note, however, that money orders are usually capped at a certain amount, such as $1,000. If you need to send a payment for more than that, you’ll have to purchase multiple money orders.

To send smaller amounts, a money order probably has an edge over a cashier’s check when it comes to convenience. That’s because you can get a money order at the bank, but you can also go to the post office, grocery store, and even some gas stations — no bank account is required. And since a money order doesn’t have your banking information on it, you might prefer it over a personal or certified check if you don’t know or trust the payee. However, the person or business being paid may prefer a cashier’s check because money orders can be more vulnerable to fraud, and it can take longer to get their money.

Wire transfers

A wire transfer is another option to consider, especially if you need to send money fast. You’ll need to know the bank name, routing number, and accounting number for the payee to start the process. Many banks will require you to visit a bank branch, especially when you need to wire a large amount, though some may allow smaller wire transfers online.

Once the bank verifies that you have the money and sends the amount you requested, the payee can access it almost immediately — there is typically no hold on the funds. This is a big pro over cashier’s checks if speed is an issue. Wire transfers are also a good option if you need to send money abroad. However, note that wire transfers are very expensive. Expect to pay $25 to $30 to send a wire transfer domestically and around $15 to receive one, according to MyBankTracker. If you need to send money abroad, you could be looking at a fee of around $50.

Be sure you know and trust the recipient of a wire transfer, since the speed of the transaction means it can be hard to recover funds in the event of fraud.

Cashier’s Checks Can Mean Peace of Mind

Cashier’s checks represent a relatively low-cost, convenient way to add a level of security to an important payment. Though you will need to head to a bank to get one, the process is fairly painless and helps guarantee your payee will receive their money.

As I outlined above, there are other ways to make a secure payment, including certified checks, money orders, and wire transfers. All have pros and cons that you should evaluate in the context of the payment you need to make.

If you simply need to make a person-to-person payment without the added assurance of a cashier’s check, check out our post on The Best Apps to Send Money. Many of these services allow you to send money electronically for free, and you won’t even need to blow the dust off your own personal checkbook.

Source;http://www.thesimpledollar.com/what-is-a-cashiers-check/

Source;http://www.thesimpledollar.com/what-is-a-cashiers-check/