|

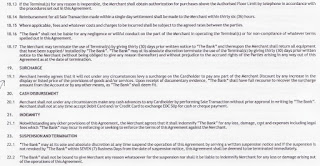

| Merchant Agreement |

According to a recent report in the New Straits Times, there are unscrupulous traders who transfer the two percent surcharge, which they are supposed to shoulder to provide credit card payment services, to their clients. Second Finance Minister Datuk Sri Ahmad Husni Hanadzlah says credit card users have been advised to report to the authorities if any merchant transfers the two percent surcharge on any transaction to them. He adds that the best way is for buyers to report such cases so that quick action can be taken.

Subsequently, a reader sends a letter to the editor of the newspaper asking about the appropriate agency to make a report. I think what the reader can do is to approach the bank in which the merchant has entered into an agreement to accept credit card payments. Inform the bank that the merchant has violated the merchant agreement. He will be able to identify the bank by looking at the charge slip. If he is unable to resolve the issue he should next approach The Financial Mediation Bureau to settle the dispute with documentary evidence.