There are 4 types of cards that you can use to make purchases. They are charge cards, credit cards, debit cards, and prepaid cards. Each type of card is specially catered to different people.

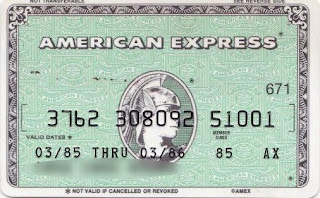

Charge Card: This type of card has no credit limit and you have to pay the amount fully when the statement arrives. It is for the rich and famous. They have spending power beyond the credit limit and they are capable of settling the amount fully upon receiving the monthly statements. Their lifestyle demands a card that they can spend freely and it is only limited by their spending power as demonstrated by their spending pattern. American Express is such a card.

Credit card: People who can exercise self–restrained will find this type of card useful. They don’t do impulse buying and they limit their purchases to what they need and not what they want. They pay promptly and fully and not just pay the minimum amount. They incur no late charges and finance charges. Visa and MasterCard fall into this category

Debit card: This type of card is suitable for young graduates who have secured their first job with decent pay and they want to have their first experience of using a credit card. The card is linked to their current or savings account so they will not overspend. They don’t run the risk of building up debt. You can’t use the card when your fund is exhausted. Visa and MasterCard are the issuers for this type of card.

Prepaid card: This type of card is for people who are budget conscious. They load the card with a specific amount for specific purposes and they spend accordingly. There is no overspending and there is no debt. You can get this type of card which is also issued by Visa and MasterCard.

Choose an appropriate card to suit your current lifestyle.