This is a guest post by Alex Brown, Marketing Head, and Editor of mortgagefit.com.

As the current economic situation is taking a toll on the US citizens, people are not getting the chance of repaying their home mortgage loan with their own funds. Most of them are looking for ways through which they can repay their loan without taking much stress on their present finances. When a homeowner is too much worried about his monthly obligations, he takes resort to his plastics in order to make life easier. However, this is not at all recommended by the financial experts it can heavily take a toll on your finances. This is the reason why it is said that a person must consider how much can I afford to pay for a house before taking out a home loan so that he doesn’t fall in danger. Though there are various credit card companies that have introduced programs that allow them to repay their home loan with their card, it is always better not to opt for this option.

Some important questions to consider before using your cards to make the mortgage payments

Even though paying back your mortgage balance with your credit cards may seem to be an appealing process, you must still ask yourself some important questions.

1. Do I have the ability to repay my balances in full?

The first and the most important question is whether you have the ability or rather the financial ability to repay your debts in full every month. On high-cost items like mortgage loans, the interest rates will always accumulate and this can make repayments costlier for you. Though the interest rates that you pay for your mortgage loans are tax-deductible, yet the credit card interest rates are not. Carrying a balance from one month to another will have a dear impact later on.

2. Will this entire process hit my credit score?

Whenever you think of repaying your mortgage payments with credit cards, you must always consider the impact on your credit score. Only when your credit limit is not enough and after you add your mortgage payments to your credit card, it consumes half of your limit, which can hurt your credit score.

3. Am I timely while paying the credit card bills?

You must always make sure that you repay all debt obligations on time so that you don’t incur late fees and penalties in the long run. On credit cards, a single late payment can cost you dearly.

Even after you get positive answers to the questions mentioned above, you must try your best to avoid repaying your mortgage with credit cards. It is always better to consider ‘how much can I afford to pay for a house’ before taking out a loan so that such a situation does not arise when you need to take the help of your credit card. You must also manage your personal finances and make payments on time.

Tuesday, September 27, 2011

Tuesday, August 30, 2011

Top Five Ways on Negotiating a Credit Card Deal

This is a guest post by Mike Brains

There are many ways you can improve your credit card deal by negotiating with your card provider. In fact, by following these tips, you could save a lot of money.

1. You should always compare credit cards. If you see a credit card with a better APR than you currently have, tell your card provider.

Often, they will reduce your APR to keep you as a customer. If they can't do this, you should transfer to a provider that offers the best credit card rates.

2. Do not be afraid to take advantage of your loyalty as a customer. If you have held a credit card for a long time, you can use this to negotiate a reduction in the interest rates or fees. Highlight how valuable you are as a customer, and your card provider may reward you.

Again, it makes sense to compare credit cards. Knowing what other companies are offering will help you negotiate with your current provider.

3. It also helps to know how you use your card when negotiating. For example, if you always pay off the balance early, then it doesn't matter if you are getting the best credit card rates. After all, you won't be charged interest if you have no balance. Instead, you should try and persuade your provider to offer rewards such as air miles or cash back. On the other hand, if you often have a balance on your card, your negotiations should be aimed towards reducing the APR and any fees.

4 Make sure you talk to someone with authority when negotiating with your credit card company. Most customer service staff won't be able to offer the best credit card rates, so ask to speak to a supervisor.

5. Finally, try to reduce any fees. Once again, it helps to compare credit cards so you can quote the fees charged by other companies.

Nothing will get your credit card company to act like threatening to close your account and go to a rival.

There are many ways you can improve your credit card deal by negotiating with your card provider. In fact, by following these tips, you could save a lot of money.

1. You should always compare credit cards. If you see a credit card with a better APR than you currently have, tell your card provider.

Often, they will reduce your APR to keep you as a customer. If they can't do this, you should transfer to a provider that offers the best credit card rates.

2. Do not be afraid to take advantage of your loyalty as a customer. If you have held a credit card for a long time, you can use this to negotiate a reduction in the interest rates or fees. Highlight how valuable you are as a customer, and your card provider may reward you.

Again, it makes sense to compare credit cards. Knowing what other companies are offering will help you negotiate with your current provider.

3. It also helps to know how you use your card when negotiating. For example, if you always pay off the balance early, then it doesn't matter if you are getting the best credit card rates. After all, you won't be charged interest if you have no balance. Instead, you should try and persuade your provider to offer rewards such as air miles or cash back. On the other hand, if you often have a balance on your card, your negotiations should be aimed towards reducing the APR and any fees.

4 Make sure you talk to someone with authority when negotiating with your credit card company. Most customer service staff won't be able to offer the best credit card rates, so ask to speak to a supervisor.

5. Finally, try to reduce any fees. Once again, it helps to compare credit cards so you can quote the fees charged by other companies.

Nothing will get your credit card company to act like threatening to close your account and go to a rival.

Labels:

Choose a credit card

Wednesday, March 23, 2011

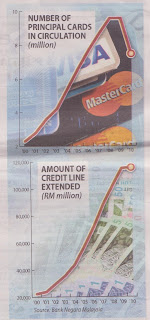

New Credit Card Rules in Malaysia

Bank Negara Malaysia is tightening credit card requirements for those in the lower-income bracket to keep household debt at manageable levels.

With immediate effect, first-time applicants for a credit card must now have a minimum monthly salary of RM2,000 from RM1,500 previously.

According to Bank Negara Malaysia deputy governor, Nor Shamsiah Mohd Yunus, new and existing cardholders earning RM36,000 per annum and less, can hold only credit cards from a maximum of two issuers. The maximum credit limit has been capped or two times the monthly income of the cardholder

For existing cardholders, they need to choose their preferred two issuers by December 31. For those existing cardholders who are earning less than RM24,000 per annum, they need not surrender their credit cards.

Nor Shamsiah said cardholders would be given at least two years to service their outstanding debt for cancelled cards to comply with the new requirement

For existing cardholders, whose outstanding balance exceeds the maximum credit limit, a grace period of two years will be given to settle the amount in excess of the maximum credit limit

From January 1 onwards, issuers shall review cardholders’ eligibility on the anniversary date of the credit card. During the review, if cardholders have fulfilled their quota of holding credit cards from two issuers, the issuer shall not extend their credit card facility to the cardholder.

Labels:

credit card news

Tuesday, October 19, 2010

Quick and Easy Ways to Become a Bankrupt

Spending money can be a fun and easy thing to do but building up debt is even easier by just carrying a few credit cards. Here are the fastest ways to ruin your personal finance:

1. Don’t track your spending: Don’t care about the formula and the budget that income = expenses + savings. All you want is just to spend as you wish. without considering your limited income

2. Just pay the minimum amount for your credit cards: Credit cards give you extra spending power. Just charge and charge to your heart’s content. When you receive the money statements just pay the minimum sum or any other smaller amount depending on the fund available in your checking account. You are not bothered to make prompt payment and you let the bank charge late payment fees and interest on outstanding balances.

3. Credit card advances: You get cash advances against your cards and buy what you want or to meet your day-to-day expenses when you run out of cash.

4. Follow your neighbors: Your neighbor has just bought a new car. You are thinking that if he can afford it you can too. You go ahead and trade-in your old car which is less than three years old.

5. Skip your loan instalment payments: By now you are unable to make ends meet. You have reached your limit for all your credit cards

and you have no choice but to skip a few loan repayments.

Your spending pattern will not last long because your financial resources are limited and your debt is attracting more and more interest and it is no longer manageable. Very soon, financial institutions where you have obtained your credit cards and loans will file bankruptcy proceedings against you.

Labels:

bankruptcy

Wednesday, September 1, 2010

Car Loans and Bankruptcy in Malaysia

According to a report in The Star, more than 500 people, mostly aged between 35 and 44 years, were declared bankrupt every month from January to May this year because they failed to service their motor vehicle loans

Once a person is declared bankrupt he will be restricted from, among others, traveling overseas, holding the post of a company director, and will have to give up his assets, including property and cars. He must contribute to the bankruptcy estate, and will only be discharged once the sum owed is settled.

Under the hire purchase agreement, the bank repossesses the car if the borrower defaults the monthly installments for three consecutive months.

It will sell off the car to recover the sum owed and if the amount still owed is more than RM30000 the bank will file a bankruptcy petition in the High court.

In the case where the sum owed is below RM30000 the bank will wait until the amount, with accumulated interest, balloons to RM30000 before filing the petition

How do you avoid a default in car loans and bankruptcy? Read 10 Tips to Avoid a Default on a Car Loan and Bankruptcy.

Once a person is declared bankrupt he will be restricted from, among others, traveling overseas, holding the post of a company director, and will have to give up his assets, including property and cars. He must contribute to the bankruptcy estate, and will only be discharged once the sum owed is settled.

Under the hire purchase agreement, the bank repossesses the car if the borrower defaults the monthly installments for three consecutive months.

It will sell off the car to recover the sum owed and if the amount still owed is more than RM30000 the bank will file a bankruptcy petition in the High court.

In the case where the sum owed is below RM30000 the bank will wait until the amount, with accumulated interest, balloons to RM30000 before filing the petition

How do you avoid a default in car loans and bankruptcy? Read 10 Tips to Avoid a Default on a Car Loan and Bankruptcy.

Labels:

bankruptcy,

car loan

Tuesday, August 10, 2010

Bankruptcy and the Management of Debtors and Creditors in Malaysia

According to a recent news item in the New Straits Times, creditors will not be able to present bankruptcy petitions against debtors unless they can prove that all avenues were made to trace the latter for repayments, and delivery of any notices actually reached them. This is under a planned reform of the Bankruptcy Act 1967.

Currently, under the act, only social guarantors are given this sort of protection as it required creditors to exhaust all avenues to recover debts owed to them by debtors.

Insolvency Department deputy director-general Haini Hassan said the reform would also see the end of creditors easily passing the bulk of work to the department to do retrieval of monies from debtors by liquidating their assets. “There is also a proposal for creditors to be given two to three years to do that before filing the petition,” she said in an interview.

The department is also planning to make it a punishable offence (in addition to the current citation for contempt of court) for bankrupts, who failed to file their Statement of Affairs to the department within 21 days after being declared so.

Haini said these reform plans would not only enable better management by both creditors and the department but would also keep the number of bankrupts in the country under control.

Haini also said it was worrying that out of the 218,561 bankrupts in the country, 60 percent were not even aware that they had been declared bankrupt.

Currently, under the act, only social guarantors are given this sort of protection as it required creditors to exhaust all avenues to recover debts owed to them by debtors.

Insolvency Department deputy director-general Haini Hassan said the reform would also see the end of creditors easily passing the bulk of work to the department to do retrieval of monies from debtors by liquidating their assets. “There is also a proposal for creditors to be given two to three years to do that before filing the petition,” she said in an interview.

The department is also planning to make it a punishable offence (in addition to the current citation for contempt of court) for bankrupts, who failed to file their Statement of Affairs to the department within 21 days after being declared so.

Haini said these reform plans would not only enable better management by both creditors and the department but would also keep the number of bankrupts in the country under control.

Haini also said it was worrying that out of the 218,561 bankrupts in the country, 60 percent were not even aware that they had been declared bankrupt.

Labels:

bankruptcy

Tuesday, August 3, 2010

Bankruptcy Trend in Malaysia

According to a recent newspaper report, there were 38357 bankrupts in the last five and a half years between the age of 25 and 44. The trend is that people who declared bankruptcy are getting younger. Here is the breakdown of those who declared bankruptcy from 2005 until May 2010:

Take-home messages

• A business venture can be successful or end in failure. The most important thing is not to put all the eggs in one basket. An emergency fund lasting three to six months to cover your normal expenses is a must.

• You can obtain a loan but it has to be included in your monthly cash outflow. If it is not within your budget. Don’t go for a loan to buy a car or a house. Save for a bigger down payment.

• You are not obligated to stand as a guarantor. You cannot control how another person manages his or her finance so you cannot be sure that the person who gets the loan will honor the loan repayments fully. Do you like to pay for something you don’t own every month? This will happen when the borrower defaulted and he or she is nowhere to be found.

• Credit card is not for getting credit (The bank will be very happy if you do): The right way to use a credit card is to back up a dollar your charge to your card with a dollar in your bank account. At the end of the month, you pay the amount due promptly and fully. The fact is that getting credit and incurring debt is easy but getting out of debt is very difficult.

• There are two things in life you cannot escape; that is death and tax. It is necessary to set aside an amount every month to cover tax payable.

Take-home messages

• A business venture can be successful or end in failure. The most important thing is not to put all the eggs in one basket. An emergency fund lasting three to six months to cover your normal expenses is a must.

• You can obtain a loan but it has to be included in your monthly cash outflow. If it is not within your budget. Don’t go for a loan to buy a car or a house. Save for a bigger down payment.

• You are not obligated to stand as a guarantor. You cannot control how another person manages his or her finance so you cannot be sure that the person who gets the loan will honor the loan repayments fully. Do you like to pay for something you don’t own every month? This will happen when the borrower defaulted and he or she is nowhere to be found.

• Credit card is not for getting credit (The bank will be very happy if you do): The right way to use a credit card is to back up a dollar your charge to your card with a dollar in your bank account. At the end of the month, you pay the amount due promptly and fully. The fact is that getting credit and incurring debt is easy but getting out of debt is very difficult.

• There are two things in life you cannot escape; that is death and tax. It is necessary to set aside an amount every month to cover tax payable.

Labels:

bankruptcy

Subscribe to:

Posts (Atom)