The most important thing about credit cards is your mindset. When you have a credit card, what is in your mind? Are you going to entertain yourself and your friends with the card or to buy things you want on credit? Stop thinking about the word credit and treat your credit card like cash. Take advantage of your credit card for the following purposes only:

The objective of holding a credit card

· Convenience: Avoid carrying a lot of cash

· Get reward points: To redeem for things you like

· Savings: Get cash rebates and pay less

· Simplify your life: Let credit card issuers settle your monthly bills

· Smart buying: Purchase big-ticket items in installments without incurring interest

· Online transactions: You need a credit card to transact online.

The wise ways to avoid credit card debt

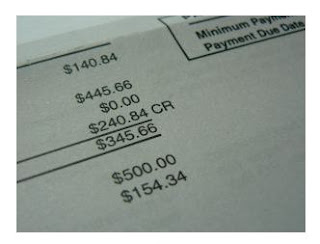

The keyword is discipline: You have to pay your credit card bill every month fully and promptly. This is to avoid charges on late payment and incur high-interest charges by paying just the minimum amount. Interest is compounded and snowballed on the outstanding amount. It can easily go beyond your means to pay and you can end up bankrupt.

Treat your credit card like cash: It means you set aside the same amount every time you charge something to your card. At the end of each month, the amount you set aside is earmarked for credit card payment.

Self-control: Control your urge to want more things in life. Stop reading advertisements that are luring you just to buy, buy, and buy.

Say no to credit: Getting into credit card debt is easy, but getting out of it is difficult. Avoiding credit and getting cash advance from your credit card is the best thing you can do for yourself.

It is a very simple idea: no credit, no debt, and no money problems.

Source: Effective Ways to Avoid Credit Card Debt

No comments:

Post a Comment