Dave Ramsey calls it getting “gazelle intense.”

The popular

get-out-of-debt guru uses the term to describe that singular state of mind in which you think of nothing other than getting out of debt and away from your creditors.

It’s an interesting concept, but Ramsey can sometimes be decidedly short on the details about how to hit that intensity.

If you’re wondering how to get gazelle intense, let us fill in the blanks. Here are seven steps to start ruthlessly attacking your debt:

Step 1: Rethink your budget from the ground up

If you already have a budget in place, this step will be easy. If you don’t, first go read this article for a simple way to create a budget.

Pull out your budget and scrutinize each and every line item. Eliminate everything that isn’t a need – and by need, we’re talking about things that help you stay alive, stay healthy, or stay in a job. Everything else can go. Cut the cable. Eliminate the Internet. Cancel the cellphone.

Then, take a second run through your budget and think long and hard about how to reduce what’s left. Could you install a programmable thermostat to save on your heating bill? Maybe cut coupons to

reduce your grocery spending? Or think really big and consider whether it makes sense to

downsize your house or trade-in your cars for cheaper vehicles.

Step 2: Stop spending

and start saying no.

Now that your budget is stripped down to the essentials, you need to flex your self-discipline muscles.

It’s time to stop

spending. That means no weekend trips to the mall, the thrift store, or the art show. Likewise, stop swinging into the farmers market or the street vendor fair just to see what’s there. Only go into stores or marketplaces if you have planned (and budgeted) purchases in mind.

Also, get in the practice of saying no. If your child wants candy in the checkout lane, the answer is no. If your spouse suggests seeing a pricey concert, the answer is no. If your friends want to go out to eat at the swanky new hot spot, the answer is no.

Of course, you need a little common sense too. Unless you want to be pegged as Mr. or Ms. Scrooge, the key is to have a free or cheaper alternative in mind that you can suggest right after your decline.

And special occasions may require a little flexibility on your part. If your friend wants to celebrate her birthday at a particular restaurant, it would be rude to demand a venue change. Assuming you can afford the meal, by all means, go and enjoy time with your friend. Don’t forget that people are more important than money – even when you’re gazelle intense.

Step 3: Limit your access to cash

To help with step No. 2, limit your ability to spend. A cash envelope system is often used for this purpose, but it’s not the only way to stop overspending.

With a cash system, you leave the debit and credit cards

at home and use cash only. However, if carrying cash makes you nervous, try a variation that involves plastic.

Open a prepaid card and load it with only your budgeted amount for the week. Make that the only card in your wallet and opt-out of any overdraft protection to force yourself to keep your spending in check.

Step 4: Sell at least half of what you own

Next, look around. What do you see? If you’re like the average American, you’re probably surrounded by items you don’t need and rarely use. It’s time to move those things out and bring some debt-paying cash in.

There are a couple of different ways to do this. You could try selling it all on a single weekend

during a yard sale. Another option would be to piecemeal it out to

get top dollar from various sources.

The best option will depend largely on your personality. Some people don’t mind intense work for short periods of time but get frustrated if a project seemingly never ends. In that case, a yard sale may be the best bet, particularly if you can combine it with a

community sale day. Other folks like the slow and steady approach, perhaps posting 10 items a week to eBay or Craigslist for small but steady cash flow.

Step 5: Earn extra cash whenever you can

Many people living in debt find their budgets are exceedingly tight. The money comes in and goes right back out. There is very little wiggle room to make extra payments. That’s why you need to stop spending and start selling.

However, go one step further and start bringing in extra income whenever possible. Depending on your individual circumstances, that could mean picking up a second job or offering to take extra shifts or overtime.

If you aren’t able to commit to a regular job, you could try babysitting, house cleaning, or even

using your smartphone to make extra money (assuming the phone is still in the budget). Plus there are a lot of

other little ways to rack up a few dollars here or there.

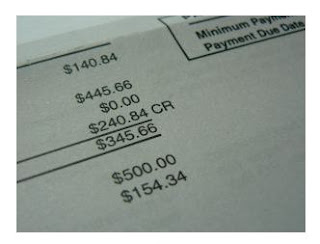

Step 6: Consolidate your debts

This step may not apply to everyone, but if you’re carrying around multiple debts with high-interest rates, you may want to consolidate.

You could do this in several ways. First, if you have equity in your home, you could apply for a line of credit. These loans often have lower interest rates than credit cards, and you may be able to deduct the interest on your income taxes. However, lines of credit may require loan fees and an appraisal, which can make them cost-prohibitive.

Another option would be a personal loan you use to pay off your other debit and credit cards. With financial institutions still licking their wounds from the Great Recession, these loans may be hard to come by.

Finally, you could transfer existing balances to a low-interest or

zero-interest credit card. Many of these cards come with an introductory period, after which the rates can zoom to the stratosphere. Be sure you’re able to pay off the debt before the promo period is over or at least transfer it to a different card. Plus, watch for balance transfer fees, which can tack on an additional 2 to 5 percent of the amount you owe.

Step 7: Set up an online bill pay system

The last step is to have a system in place to get all of the money you’re saving and earning to your creditors as quickly as possible. It defeats the purpose of selling the DVD collection if you use the money to buy your family dinner from McDonald’s.

You can find free online bill pay services at many banks and credit unions. Sign up, input payment information from all your creditors, and decide which bill to attack first. Then, every time you get some extra money in your account – whether it’s $10 from an eBay sale or $1,000 from an

awesome yard sale – send it straight to your creditor. As in, make the payment that day.

Don’t let the money get cozy in your checking account. The longer it sits there, the more likely you are to use it for something else. When the money comes in, send it right out, and soon you’ll enjoy the peace of mind and financial freedom that comes with being debt-free.

Source:

7 Steps to Get Ruthless About Paying Off Your Debt